Tax Advising Across Borders

Sunday, August 13, 2017

יואל פנחס תפילין - -058-6672131

אם מצאת תפילין שכתוב על התיק שלהם "יואל פנחס", בבקשה להתקשר למספר 058-6672131. תודה

Saturday, October 11, 2014

Taxation of U.S. Trade or Business, or Permanent Establishment

In the last post, I wrote about the system by which the U.S. attempts to tax mostly passive forms of income earned by foreigners. I mentioned that the rationale for that system derives from the reality that, because of the unique challenges in imposing tax liability on foreigners (who are for the most part outside the reach of U.S. courts and therefore are beyond effective enforcement of their tax bills by the usual means) the U.S. created an alternative system for the collection of such taxes which makes partners out of the U.S. payors who are the sources of these types of income. Through the rules found in IRC Section 1441 governing withholding agents and FDAP income, the U.S. imposes its will and insures that it will receive its share of the income of foreigners who invest in U.S. assets.

But the need for this system presumes the challenges we mentioned regarding the collection of these taxes and is therefore limited by design to such situations. What is the mechanism by which the Code identifies situations where it doesn't face this challenge of collecting and what then is the method by which it collects in these circumstances? Put another way, what will it take for the U.S. to relax when foreigners earn income and be reasonably assured that it doesn't need to impose draconian gross taxation on these foreigners?

The answer is that if a foreigner has what is called a "U.S. trade or business" and the income is effectively connected with that trade or business, or "ECI", then the income will not be taxed under IRC Section 871(a) (for individuals) and 881 (for corporations). Rather, under IRC Section 871(b) (for individuals) and 882 (for corporations), if a foreigner earns ECI then it is taxed the same way a U.S. person is taxed, i.e. under Sections 1, 11 and 55 of the Code. This means that the taxpayer will be able to net their effectively connected expenses against this income and, depending on the facts of the case, may be subject to a lower effective rate of tax as a result.

Presumably, the thinking behind this is, once a business has income which is connected to a "U.S. trade or business", the courts will have sufficient leverage to go after the business if they don't pay their taxes.

The question of whether or not income is ECI is a "facts and circumstances" type of question. The Code doesn't really define the term and leaves it up to the courts to decide. Different court cases speak about the factors to be consideed for different types of income, e.g. many court cases deal with the question of how much and how frequently must a business make loans to third parties to be deemed in the business of making loans, and therefore such loans will be ECI instead of merely "passive" investments. But every type of income is different and it can frequently be difficult to show that the usual categories of passive income are ECI in a particular case.

It is far more likely that, assuming certain other factors are present, income from sales or services are going to be treated as ECI. But it isn't enough to merely see these types of income. In general, courts will look for certain types of regular, substantial and continuous activities that will constitute the "U.S. trade or business" ("USTB") part of the ECI definition. Such business activities should not be demonstrably single or isolated incidents. The Regulations have some guidance for determining if income is effectively connected in Treas. Reg. 1.864-3 so that section of the Regulations should be consulted as well. This substantial and continuous presence is the reason why the U.S. feels more confident about its ability to enforce tax liability on the foreign business. At this point, the foreign business presumably has too much to lose if it dares ignore its tax responsibilities.

In practice, the ECI standard is generally replaced by application of one of the many US income tax treaties signed by the US with a wide network of foreign countries. Under the treaties, business income is generally exempt from taxation outside the country of residence as long as the business doesn't have what is referred to as a "permanent establishment" in the country where the income is being earned. "Permanent establishment", or PE is a similar but slightly more taxpayer friendly term than U.S. trade or business under the IRC. An example of when PE may be more friendly than USTB is where the only presence is based on a consignment arrangement. See Rev. Ruling 63-113 and Rev. Ruling 76-322. It is also worth noting that different treaties have different details regarding the definition of PE; for example, the U.S.-Israel income tax treaty specifically creates a PE where a foreign business both buys and sells inventory within the U.S. However, it is worth pointing out that just because you have a PE, it doesn't mean you can't try to be exempt from U.S. tax by referring to the USTB definition instead. I have seen cases where we could not take the position that a client didn't have a PE for the reason mentioned previously but were still able to take the position that no USTB existed.

Bearing in mind the explanation of ECI, USTB and PE above, there is an exception situation where the U.S. imposes withholding tax even on ECI. This is where the ECI is earned by a partnership which has one or more foreign partners. IRC Section 1446 imposes withholding tax at the highest rate of tax for either individuals or corporations under IRC Sections 1 and 11. Essentially, it imposes 39.4% withholding on individuals and 35% withholding on corporations who are foreign partners in a partnership with ECI. The policy rationale is fairly easy to guess; since the income is immediately recognized by the foreign partners at the partnership level, we return to the situation where the U.S. may not be able to coerce the partner to report and remit tax on that income since they are located outside the U.S. when it is accrued. This withholding regime does allow for reducing the effective withholding rate based on the partner's ability to substantiate that their effective tax rate will be lower than the top rate through deductions and other means.

Friday, September 12, 2014

An American Owner in Paris - CFCs and Subpart F

In the last post, I discussed some general concepts about what drives the tax system as it pertains to companies who are based outside the U.S. but wish to enter the American market. I emphasized that the U.S. is jealous of its taxing prerogative and has devised many ways to make sure it gets a fair piece of the pie (at least, what it considers fair). As you, the tax practitioner, see additional specific instances where the IRC imposes specialized taxes to deal with different situations, you will learn to anticipate these narrow rules and you will also begin to anticipate their limits.

One such example, but in the opposite direction (i.e., where an American invests abroad) is the Controlled Foreign Corporation ("CFC") rules. These rules are found starting in IRC Section 951 through 965 and are commonly referred to as "Subpart F" (because they are part of Subtitle A, Chapter 1, Subchapter N, Part III, Subpart F of the IRC).

The CFC rules were created to target situations where a U.S. person uses a foreign entity which it owns (this is the CFC) to earn specific types of income and taxes that income in the year it was earned by the foreign entity. But for the application of Subpart F, this income would not be currently subject to tax and would only be taxed in the U.S. when it was paid as a dividend from the CFC to the U.S. owner. Congress therefore targeted two situations which it felt to be abusive. First, it targeted certain situations where the income didn't really need to be earned by that entity and it should therefore be assumed that the U.S. owner is conducting the business through the CFC for the purpose of avoiding U.S. tax through potentially endless deferral. Second, it targets certain types of transaction by CFCs which have the practical effect of circumventing the need for the CFC to pay a dividend.

Volumes can be written about Subpart F. For this post, I will begin to describe the first category above and I will hopefully get to the second category (IRC Section 956 dividends in case you want to skip ahead) in a later post.

IRC Section 951 says that all "U.S. shareholders" of a "controlled foreign corporation" who earn "subpart F income" are required to include such income in their net income in the year in which it is earned. This means essentially that certain types of income - "subpart F income" - are deemed to be earned both by the CFC and the US Parent simultaneously. But in order to know when this rule will apply, each of the preceding phrases needs to be defined in order to understand how this works.

- CFCs are defined in IRC Section 957 as any foreign corporations who are owned at least 50% by U.S. persons determined by reference to either voting power or the total value of the company ("vote or value")

- "U.S. shareholder" is defined in IRC Section 951(b) as any U.S. person who owns 10% or more by vote or value of a CFC

- "Subpart F Income" is the most involved definition and includes several different categories of income, each of which is a term of art under the Code and needs to be defined through additional complex rules in turn.

Subpart F Income Categories

Since each of the various categories has lots of nuanced rules that I have no intention of adequately explaining here, I will merely discuss the underlying themes of these categories so you as the new practitioner can approach the rules with a framework in mind.

One category of subpart F income, called Foreign Base Company Income, is from my experience the most important category for most international businesses. Within that category, there are several subcategories, each of which can be understood based on the U.S. tax policy underlying the definition. One of these, Foreign Personal Holding Company Income, essentially aims to target CFCs who earn certain types of passive income and make that income taxable in the U.S. The idea behind this, similar to Passive Foreign Investment Company (PFIC) rules, is to make it difficult for U.S. taxpayers to defer income recognition through the use of foreign investment entities.

The next set of Foreign Base Company Income types you should watch out for are two categories covering one basic problem: Foreign Base Company Sales Income and Foreign Base Company Services Income. These categories target business arrangements where a CFC is doing business in a foreign country other than its resident country, either earning sales or services income. The idea here is that allowing a CFC to earn income all around the world will make it very easy for U.S. persons to set up shell companies to unfairly defer income from their worldwide operations without necessarily paying local taxes in the jurisdiction where they earn the income. The rule here concedes some deferral if you are willing to set up a corporation in the country where you want to make your money (which means you will likely be taxed locally) but draws the line on this deferral where it is likely to cut down on abusive structures.

The last type of Foreign Base Company Income is Foreign Base Company Oil Income. I'm going to ignore that category since it applies to a narrow range of businesses.

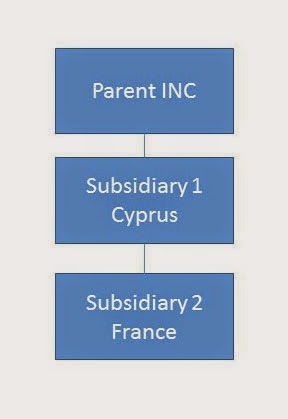

An Example - US Company with two Subsidiaries

An example of a relatively common situation in a multi-national company involves a situation where a CFC makes a loan to another CFC in a different country. In additional, one of the CFCs has branches in other countries and has sales in those countries.

In this example, Subsidiary 1, located in Cyprus, wants to loan money to Subsidiary 2, located in France. Absent any issues arising under the Code, this can be very beneficial for several reasons. First, it is better to loan the money from Cyprus than from the U.S. Parent because the interest income generated from the loan will be taxed at a lower rate in Cyprus than in the U.S. (about 12.5%). Second, France will generate interest expense on the loan which will erode the tax base in France (where there is a similarly high corporate tax rate compared to the U.S.) and shift the income to Cyprus, which has a significantly lower rate. All in all, this would be a pretty great outcome and would result in significant tax savings, just for doing nothing but cleverly moving some money around. (I am ignoring several potential issues with this which may affect the outcome)

However, the CFC rules prevent this from working because the interest income will be considered Foreign Personal Holding Company Income. This interest income will be immediately recognized by both Subsidiary 1 (obviously) and also by Parent INC under the Subpart F income rules. As a result, the Parent will recognize income in the amount of the interest payments and such income will be subject to corporate rates of 35%. This defeats the benefit we observed above and is just one of many deterrents to erosion of the U.S. tax base through foreign related entities.

There used to be a rule which expired at the end of 2013 which would have helped us. The rule, known in the biz as the "look-through" rule exempted passive income which originated from sources which earned non-Subpart F income. Under this former rule, if Subsidiary 2 had been making money in a non-Subpart F way (such as through sales within its country of residence), it could then borrow money from Cyprus and make interest payments to it without triggering Subpart F. So this rule was pretty helpful for taxpayers, but it was part of the "tax extender" legislation and it expired along with most of the rest of the tax extenders. Many practitioners expect it to return when Congress eventually gets around to doing a new tax extenders bill but this should only be treated as speculation until such legislation is actually passed.

Friday, August 22, 2014

What's Mine is Mine, and What's Yours is Also Mine - Withholding Under the Code

Withholding Under IRC Sections 871/881 and 1441/1442

"Annual" in this context means that it is generally paid at least on an annual or more frequent basis. This is pretty self-explanatory. "Periodical" means that the income pertains to the use of something for a specified period of time. On the example of interest, the interest income here is "periodical" because you receive it for allowing the borrower to use your cash in a loan agreement for a period of time and are compensated at a rate depending on the length of that period. Capital gains, which are generated by the one-time sale of an asset, are not annual because they only happen once and they are not periodical because they represent a sale of something whose value isn't measured by reference to a specific period or periods of time.

Bucking the assertion that IRC Section 871(a) is concerned with passive income, FDAP income here also includes compensation for services. Thinking about the terms "annual" and "periodical" again, this makes sense when you think about typical employment and the form that the compensation for services usually entails. Services are most often compensated by paying wages to an employee. The amounts paid are measured on a regular (usually far more frequently than annual) basis and are determined by reference to a period of time over which the service is provided by the employee. As such, compensation for services, both as an employee and as a third-party contractor, are sufficiently "annual" and "periodical" and are therefore included under the FDAP taxing regime.

For all these types of income, IRC Section 1441 authorizes and requires the payors of such income to undertake the role of the withholding agent. Each such payor who makes FDAP payments to a foreign person is required to withhold based on IRC Section 871 and remit the withholding amount to the IRS.

How does the withholding agent know who is a foreign person from whom they need to withhold? For every person to whom they make a FDAP payment, all payors must request a signed withholding certificate which represents to them that the person is either a U.S. person (and therefore not subject to withholding) or a foreign person. The withholding certificates are forms published by the IRS and are called Form W-9 (for U.S. persons) and Forms W-8 (for foreign persons, and there are lots of types of Form W-8 depending on the type of recipient).

There are a number of types of foreign persons who are exempt from the tax imposed by IRC Section 871. Specific exemptions can be found throughout the Code but examples include recipients of effectively connected income with a U.S. trade or business (ECI), foreign governments, and recipients of portfolio interest income, amongst many other types of exemptions.

In addition to the exemptions provided by the Code, the U.S. has entered into a large number of tax treaties which provide residents of the counterparty country with either exemptions or reduced withholding under the treaty. Each treaty's terms are different to varying degrees and it is necessary to check each treaty to determine the extent of any benefits (and whether the recipient qualifies for benefits under the treaty). But it is common under these treaties for reductions (though not usually complete eliminations) in the rates of withholding for interest, dividends and royalties. It is also common for such treaties to generally eliminate entirely the withholding on compensation for services and rents, subject to certain limitations on the involvement of the foreign resident in the U.S. All these treaties generally provide similar benefits in both directions, meaning, foreign residents will benefit for income earned in the U.S. and U.S. persons will benefit for income earned in the foreign country.

An Example of Some Tax Planning

I've been speaking very generally until this point about withholding and laying a lot of groundwork so the unfamiliar reader can understand the basics (and there is plenty that I haven't even touched on). But let's skip ahead for a moment and take a look at a relatively common type of planning that derives from the rules we discussed above. Let's think about a business that sells a new type of medical device it invented in its country of origin (hereafter "Country X") and now wants to sell in the U.S., putting aside the regulatory hurdles that such entrance generally entails.

The business wants to consider what would be the best way to structure its operations to minimize and/or delay its tax liability as long as possible. We will assume the business has a large number of employees in Country X who are actively involved in a range of activities, from sales to R&D to manufacturing to management. In order to get the U.S. business off the ground, the company will want to have some employees doing sales in the U.S.

Under the facts above, we have a few basic challenges to overcome. First, we have the problem that the U.S. generally taxes at a higher corporate rate than most other countries (and might tack on a branch profits tax on top of the normal corporate tax), but we'll put that aside. Assuming the company decides to create a U.S. subsidiary to handle it's U.S. sales, it will want to use the knowledge and intellectual property of its parent which are a necessary part of the medical devices that the company creates. Now, it could decide to pay the parent for the right to use the intellectual property and then go ahead and sell the devices. But this would result in withholding tax on those payments, which are royalties and therefore FDAP. While many treaties reduce the 30% withholding, they usually don't eliminate it entirely. So you may be stuck with, for example, an additional 15% withholding on such payments (which may or may not be creditable in Country X depending on several considerations). So what might we be able to do to avoid this?

Well, one viable option is to change the terms by which the U.S. subsidiary and the parent in Country X do business together and in the U.S. We had previously assumed that the U.S. would be selling the devices on its own and for its own benefit. It would then pay a royalty fee to the parent (which it has to do or the taxing authorities will get very upset if it gets the use of the intellectual property for free). So what can it do instead which will substantially result in the same business arrangement but eliminate the need to withhold on royalty payments?

We can set up the following arrangement: Instead of selling the devices directly and for its own benefit, INC will provide "marketing and pre-sale" services to the parent. All sales will occur between the parent in Country X and the customer in the U.S. directly (and as a legal matter). The parent will then compensate INC for its services by paying for its costs plus a small percentage so it can have a profit (this is important for a separate requirement of the Code under IRC Section 482 called the "arm's length principle", also known as the topic of transfer pricing).

What will be the net result? We will have all the same employees on the ground in the U.S. helping to make sales for the company. We will avoid the need for paying a royalty from INC to the parent because INC isn't actually selling the device; rather, the parent is. And there may be other benefits as well such as moving a substantial amount of the income which might have otherwise been taxed in the U.S. to Country X, which likely has a lower corporate tax rate (most countries around the world have lower corporate tax rates than the U.S.)

There may be other considerations that would make this proposed solution undesirable. In general, it's important to fully understand the needs of each client in order to come up with solutions to these types of challenges. But the underlying principle here is that with proper planning and management of the facts surrounding a business's structure, you can achieve substantial tax benefits and reduce your tax burden from what it might otherwise have been in the absence of such thoughtful planning.

Friday, August 8, 2014

So You're Thinking About Expanding Into the U.S...... (or Vice-Versa)

While I plan to eventually delve into more specific cases and scenarios that I am experiencing in my practice, I want to hold off on that for the next few posts in order to look at the topic of tax advising on cross-border transactions and businesses from a bird's eye view. Thus, for this post I want to speak more generally about some of the common pitfalls and challenges which are introduced when a company enters the U.S. market from a foreign country or vice versa. My discussion will highlight the fact that most of the issues imposed on such companies by the Code have fairly reasonable and intuitive rules. An important step towards mastering the rules and especially being able to speak generally about the rules with clients is understanding the goals which motivate each rule and developing your intuition until you can frequently guess what the tax treatment is likely to be under the Code.

So let's lay some basic groundwork about the international tax system before getting into specific rules. I should clarify the previous sentence; when I say "international tax system", I am referring to the U.S. system for taxing international transactions. The U.S. has a very elaborate system in place (and is probably the most aggressive country in this regard) of taxing cross-border and even foreign transactions where it believes it is entitled to tax.

It is worth highlighting that the goal of the U.S. tax system is ultimately to collect taxes. There are many specific rules which attempt to make the collection of such taxes either more "fair" or are an attempt to engineer certain non-tax outcomes. But ultimately the tax system is an extremely important source of revenue for the U.S. government and the rules reflect this priority of the tax system.

Taxing foreigners is hard. The basic problem of taxing foreigners is that, unlike U.S. persons, foreigners are harder for U.S. authorities to reach. This challenge for the U.S. tax system comes down to the fact that, when all is said and done, a judge cannot simply send a marshal to a delinquent's house and bang on their door to get them to pay up. Nor is this person likely to have assets in the judge's jurisdiction (i.e., the United States) that a marshal can seize. This sort of concern is what led to the system of withholding put in place by the U.S. for types of income that might be received by someone who will never be heard from again. Instead of waiting for the recipient to acknowledge their obligation to pay taxes on income sourced in the United States (what income is sourced in the U.S. is a separate and involved question), IRC Section 871(a) imposes a gross tax of 30% (by default, but frequently reduced by treaty) on primarily passive types of income such as interest, dividends, royalties, rents and others. Furthermore, IRC Section 1441 creates joint and several liability for "withholding agents" who are obligated to withhold and remit the tax liability created by this regime and insures compliance with the tax. The income taxed under these rules is commonly referred to as FDAP income (Fixed, determinable, annual and periodical income; this essentially means passive income such as what I listed above)

Thus, if you are a foreign person interested in opening a business or otherwise earning money in the U.S., you need to consider the impact of the withholding regime on your bottom line and plan accordingly. You can start to consider the relative merits of many types of tax planning depending on your needs and expectations. For example, you can create a U.S. domestic corporation to receive the income and keep it in the U.S. This at least delays the imposition of withholding tax. Or you can structure your contracts to have your business provide certain services or goods which have preferential treatment based on rights derived through mutual tax treaties between the U.S. and your country of residency. But one thing is certain; you do not want to simply ignore the possibility of 30% gross withholding on your income from the U.S., which is likely far higher than the tax you will be required to pay in your country of residence and may therefore result in more tax credits than you can utilize locally.

There are other ways that the U.S. can tax you as a foreigner. Keeping in mind the consideration above about the difficulty of reaching foreign recipients of U.S. income, what if you are a foreigner that has a more permanent presence in the U.S.? The withholding regime mentioned above is rather draconian in that it doesn't give you any benefit for the expenses you incurred in earning the income, something most tax systems will generally try to do. Most businesses would prefer to net their revenues against their expenses and pay tax on the net (even if the rate is higher at 35%, the effective tax rate is still lower). So the U.S. rule under IRC Section 871(b) (for individuals) and 882 (for corporations) is to tax this income like any other business income in the U.S. Why is this situation different from the way they tax (mostly) passive income mentioned above? Because the presence of a trade or business operating in the U.S. gives enough assurance that you have a continuous presence in the U.S. that the IRS can go after if you don't pay your taxes and take the income outside of the country.

What I have discussed above is just the tip of the iceberg and there are many other specific regimes used by the U.S. to tackle the challenges outlined above (and other challenges related to cross-border transactions). To a practitioner, it feels like an endless list of specific and seemingly unique considerations which come into play depending on the facts of a case. But as you, a tax practitioner or other party involved in tax, start to encounter these specific rules and regimes, you will develop a feel for when a transaction 'feels' like the U.S. will want to tax it in a special or specific way and when other more 'default' rules might apply.

Thursday, July 24, 2014

Tax Advisors - Why We Matter (Levels of Assurance)

Introduction

Hi.

Since this is my first post, I should probably introduce myself. My name is Paul Haimowitz. I studied law at Georgetown University and am admitted to practice in New York State. Since graduating, I have worked at 2 of the Big Four accounting firms in a variety of roles revolving around tax. I have spent significant amounts of time in tax compliance as well as consulting. My areas of focus have been mostly international issues, both on the compliance and consulting side.

I am not the only person doing what I do. There are lots of very bright people out there providing similar services and there is a huge amount of demand to keep these people busy. But tax is hard. It's an enormous subject matter and I clearly recall the strong initial impression that it was overwhelming. At the same time, I was enamored of the people I met who had apparently mastered the art (the late Professor Martin Ginsburg, with whom I had the privilege of taking all of his available courses while I was at Georgetown, personified the tax expert in my eyes as a student) and I wanted to become like them. My thinking was that if you aren't truly an expert at something, you haven't accomplished anything worth accomplishing. I still feel this way, but the difference between then and now is that I now feel like I am on the path and heading in the right direction. But everyone needs to start somewhere and it doesn't seem like anyone I have spoken to really attempts to break down the process of becoming adept at tax law into manageable pieces.

So I hope with this blog to accomplish two things. I want to talk about interesting cases that I haven't seen in any readily available literature. I frequently come across situations that seem like they should be relatively common, and yet nobody has written about them. So I'm going to do my part and relate the analyses and conclusions I and my coworkers arrived at in the course of our practice.

Second, I want to make the practice of tax a little bit simpler to appreciate and digest. I want to give people who are lost or on the fence or feel overwhelmed a starting point. And I want them to understand that giving advice is a process which mixes effort, uncertainty, and best judgment. Particularly in the complex world of tax, it is vital to develop a feel for the discipline and in particular to develop a feel for when you have done 'enough' to provide a good and valuable service.

With that being said, let's move on to my first (and hopefully you will agree highly appropriate) topic.

Why We Matter (Levels of Assurance)

Hi.

Since this is my first post, I should probably introduce myself. My name is Paul Haimowitz. I studied law at Georgetown University and am admitted to practice in New York State. Since graduating, I have worked at 2 of the Big Four accounting firms in a variety of roles revolving around tax. I have spent significant amounts of time in tax compliance as well as consulting. My areas of focus have been mostly international issues, both on the compliance and consulting side.

I am not the only person doing what I do. There are lots of very bright people out there providing similar services and there is a huge amount of demand to keep these people busy. But tax is hard. It's an enormous subject matter and I clearly recall the strong initial impression that it was overwhelming. At the same time, I was enamored of the people I met who had apparently mastered the art (the late Professor Martin Ginsburg, with whom I had the privilege of taking all of his available courses while I was at Georgetown, personified the tax expert in my eyes as a student) and I wanted to become like them. My thinking was that if you aren't truly an expert at something, you haven't accomplished anything worth accomplishing. I still feel this way, but the difference between then and now is that I now feel like I am on the path and heading in the right direction. But everyone needs to start somewhere and it doesn't seem like anyone I have spoken to really attempts to break down the process of becoming adept at tax law into manageable pieces.

So I hope with this blog to accomplish two things. I want to talk about interesting cases that I haven't seen in any readily available literature. I frequently come across situations that seem like they should be relatively common, and yet nobody has written about them. So I'm going to do my part and relate the analyses and conclusions I and my coworkers arrived at in the course of our practice.

Second, I want to make the practice of tax a little bit simpler to appreciate and digest. I want to give people who are lost or on the fence or feel overwhelmed a starting point. And I want them to understand that giving advice is a process which mixes effort, uncertainty, and best judgment. Particularly in the complex world of tax, it is vital to develop a feel for the discipline and in particular to develop a feel for when you have done 'enough' to provide a good and valuable service.

With that being said, let's move on to my first (and hopefully you will agree highly appropriate) topic.

Why We Matter (Levels of Assurance)

I have been doing work in tax for several years now following graduation from law school. In that time, I've been involved in the preparation of numerous tax returns and drafted memos concerning a wide range of issues. Although I am admittedly somewhat removed from many of the economic aspects of what I do (something I am certain I will become more familiar with in time as I become a more senior practitioner), it only recently occurred to me that I had never adequately answered some fairly fundamental questions regarding the provision of tax services. First, why do so many of the tax return preparers I have worked with assign such gravity to insuring the correctness of the information in the return? There appears to be a particular sensitivity to this amongst the people signing off on the returns. What motivates this concern, especially if a client is willing to take responsibility for any doubtful tax return positions

Second, what is the benefit for a client of receiving a tax opinion from a tax professional (either a law firm or an accounting firm)? I always assumed that it might simply be a corporate legal issue where the Board of Directors, in its fiduciary capacity, might need to show it engaged in sufficient due diligence for corporate liability purposes.

Both of the above questions seem pretty fundamental but I have never really heard from any of my various mentors about the topic. I have been aware that the art of memo drafting contains a concept where the memo issuer offers varying levels of assurance but knowing that still begs the question of what exactly do different levels of assurance buy you aside from perhaps some sort of limited indemnity from the firm issuing the opinion.

This question is answered, at least in part, in IRC Section 6694. This section lays out rules for the avoidance of penalties by virtue of the taxpayer having done their due diligence to check up on unclear tax issues and challengeable positions. Obviously, if you take a position and the IRS successfully challenges it, you will be liable for any additional tax liability arising from the IRS adjustment. But it might seem unfair that the taxpayer should additionally be hit by penalties where the taxpayer made their best effort to comply. Often, the taxpayer is simply trying to be as correct as possible but the IRS still disagrees (rather than aggressively trying to save some money). So the Code has a safe harbor provision which protects taxpayers in these and other similarly well-intentioned situations through the definition of "unreasonable positions".

The rules in this section were updated to reflect new legislation passed in 2007 as part of the Small Business and Work Opportunity Act of 2007. The IRS issued guidance on the rule in Notice 2008-13 - I won't go into the historical rules in this discussion. The new rules allow for the reliance (for purposes of penalty avoidance) by a tax return preparer based on several distinct levels of assurance.

The first, "substantial authority", requires that the taxpayer believe that the chances that the taxpayer is correctly applying the tax rules are greater than the chances that the taxpayer is incorrectly applying the tax rule. I understand this to be a plurality rule, by which I mean the taxpayer's position must be the most likely to be correct of all the various possible interpretations. This is akin to a "more likely than not" type of standard. If the taxpayer can support this, then they will be exempt from penalties under this section. But this is a tough standard to meet. After all, if the IRS doesn't agree with your position, they probably aren't going to agree that it was the most reasonable of all the positions to take.

This is where tax advisors come in. If you can show the IRS that you received an opinion from a competent tax authority, in which it is opined that there is substantial authority to support your position.

The second standard, "reasonable basis", is a lower standard of certainty than "substantial authority" and is allowed only with the inclusion of an additional factor; disclosure. In order to rely on a reasonable basis opinion, the taxpayer needs to disclosed to the IRS "the relevant facts affecting the item's tax treatment" on their tax return. It's worth pointing out that this doesn't require you to show all your cards; you don't have to do disclose the position or your reasoning. All you need to disclose are the facts and it is up to the IRS to put them together in order to challenge your position.

The final standard is the "more likely than not" standard. IRC Section 6694(a)(2)(C) indicates that this standard requires that the position be more likely than not to be sustained based on the merits. This standard is the most difficult to reach of the above 3 positions but it gives the added benefit of eliminating the penalty where the taxpayer is found to have created a tax shelter as well as positions to which IRC Section 6662A apply (reportable transactions).

I encourage both advisers and consumers of tax advice to read the above citations and the associated regulations. It will give advisers a better feel for the amount of value they bring to their clients and it will inform consumers as to what they are actually purchasing. Obviously, there is a lot more to the value of tax advise than abatement of penalties. But this is a concrete source of value that is more easily quantifiable. As a tax advisor, I appreciate any point of reference that provides a framework from which I can help my clients appreciate the value I can bring them.

I would appreciate any comments and especially technical corrections. Please feel free to post because I'd love to hear your thoughts.

I would appreciate any comments and especially technical corrections. Please feel free to post because I'd love to hear your thoughts.

Subscribe to:

Posts (Atom)